Download the full Press Release here ( PDF )

Massachusetts Alliance Against Predatory Lending

www.maapl.info maaplinfo@gmail.com

For Immediate Release: 6/20/2023

Contact: Grace Ross – MAAPL coordinator, (617) 291-5591

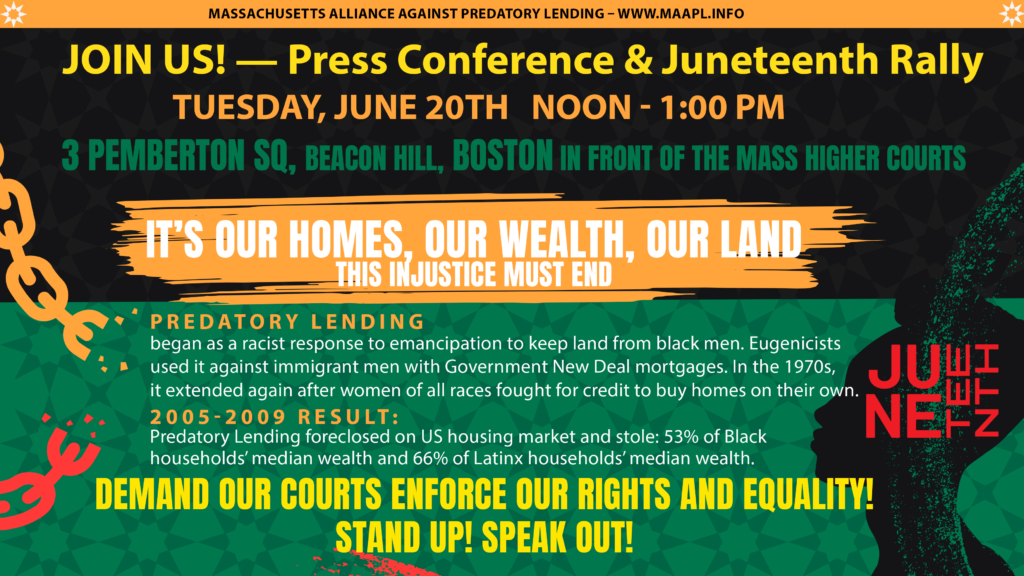

HOMEOWNERS AND THEIR SUPPORTERS REVEAL 150 YEARS OF PREDATORY DISCRIMINATORY LENDING AND DEMAND JUSTICE NOW!

Today, Boston, in Pemberton Square, in front of the Massachusetts higher courts’ building (Massachusetts Supreme Judicial and Appeals Courts), a dozen homeowner-activists from across the state and their supporters came together in a press conference “tying together that the present ‘doomed to foreclose’ mortgage packages are just the most recent expression of 160 years of predatory lending to African Americans”.

“They are serving their traditional wealth stripping function”, Alton King of Longmeadow, MA, who opened the press conference explained. “This has left me and those similarly situated in the expected position of having had our wealth stripped, a denial of the protection of the courts, which has destined me and those similarly situated to another generation of failure to enforce against violations of equal protection in house.”

King had explained about the predatory nature of the origination of his own mortgage package, overpriced beyond the actual value of his home, split into two mortgages that he had started out paying $3,216 per month and ended up with a $13,400/month bill.

Elenice Umana of Brockton, MA spoke, following on the heels of King’s explanation. She spoke of the urgency for the courts to treat equally those who are black and those who are immigrants or speak differently, that everyone has an equal right to their home.

Grace Ross, the coordinator of the Mass Alliance Against Predatory Lending, who emceed the event, then pointed out that King and Umana are two of three present homeowner foreclosure fighters who were given an uniquely and clearly illegal loan, where they were billed one interest rate and then an even higher interest rate was actually being charged by the mortgagee every month. So, as they paid, they owed more money over time. What they were being billed was not the full extent of what they were being charged.

Jeb Mays of Cambridge, MA quoted from the powerful researcher’s work all of the way back to emancipation on predatory lending, Charles Nier, III, that merchants who were “the most important economic power in the Southern Countryside had maintained a two tier pricing system with a differential of a median of 33.6% to a maximum of 89.6% interest.” And, “White subjective determinations of credit-worthiness were undoubtedly tainted with racism.”

As still apparent, the most famous of the large settlements as to racist predatory lending with a bank, the Countrywide settlement, found that it was the brokers being allowed to make a subjective determination of the credit-worthiness of borrowers to this day that have led to the differentially overpriced mortgages to people of color, as opposed to white borrowers.

Gary Yard of West Springfield, MA talked about the overpriced loan beyond the value of the property that had been split into two loans, even though they were underwritten together. That the originator had lied to the underwriter inflating his income. Then, it became unaffordable, and this could happen to anybody. He pointed out that the splitting of the underwriting of one loan into two offered to the homeowners was a standard practice to avoid the regulatory oversight based on the major federal laws that have been passed to protect homeowners.

Both Umana and Yard, as immigrant borrowers, fit the pattern that came in in the 1930s with the New Deal of “rating neighborhoods”, and that “none of the socioeconomic criteria were more important than race,” and that “when the Homeowners’ Loan Corporation obtained a property through foreclosure, its sales policy was to ‘respect segregation and encourage it’.” Thereby, the predatory lending was expanded from black borrowers to include immigrant borrowers.

Jeb Mays, a supporter of the homeowners, explained that there was a decision from 1974, the Clark v. Universal Builders, Inc. from Chicago that explained that the predatory practices “forced African Americans to devote more of their incomes to housing to the detriment of other basic necessities, including education, medical care, food, clothing, home improvements, and recreation.”

As Grace Ross then explained, giving up the necessities of life is to this day the choice that homeowners who fight for their homes in our courts are being forced to make. As the group insisted, these practices must be changed. The Massachusetts courts have the power and the responsibility to enforce our equal protection rights to property for all Massachusetts residents.

Chris Hrycenko of Brockton and Laurie Endsley of Clinton then both told stories as white women of the expansion of predatory lending to women heads of household borrowers, when women could finally get credit, thanks to the Women’s Movement, in their own name. Both of them had paid for years and still found that at that point they owed more than when they had originally gotten their mortgage. As Hrycenko quoted, “Although redlining communities of color was not illegal, discrimination based on gender or marital status was not only legal, but considered sound business practice.” For example, 1973 Congressional hearings document one VA official stating that, “It is unamerican to count a woman’s income”, and that the would only support counting a woman’s income “if she were to have a hysterectomy.” U.S. 93rd Congress, 1973.

In short, the homeowners stated with their supporters that now is the time and that it is critical that the courts, our government, and, in fact, people in general stand up and demand equal property rights for all. “It is when everyone has justice and thrives that we all benefit,” closed Grace Ross.

Participants then joined in the Anti-Foreclosure Movement’s mantra, “When we fight, we win. When we fight, we win. When we fight, we win.”

(END)

On Wednesday, December 7, 2022 in Salem, Massachusetts, the South Essex County Register of Deeds, the Honorable John L. O’Brien, Jr., announced at a press conference at the Salem Registry of Deeds that he has filed to intervene in the so-called securitized trust’s court case against Dr. Esther Ngotho. The press conference was also streamed on Zoom, and the recording of the Zoom conference is available for viewing below.

On Wednesday, December 7, 2022 in Salem, Massachusetts, the South Essex County Register of Deeds, the Honorable John L. O’Brien, Jr., announced at a press conference at the Salem Registry of Deeds that he has filed to intervene in the so-called securitized trust’s court case against Dr. Esther Ngotho. The press conference was also streamed on Zoom, and the recording of the Zoom conference is available for viewing below. On Friday, November 18, 2022, Alton King, a Black senior with a disability who had been wrongfully evicted from his Longmeadow, MA home, returned to his house for the first time in over a month.

On Friday, November 18, 2022, Alton King, a Black senior with a disability who had been wrongfully evicted from his Longmeadow, MA home, returned to his house for the first time in over a month.